The bottom line: Alternatives in order to an other financial

7 Tháng Mười, 2024

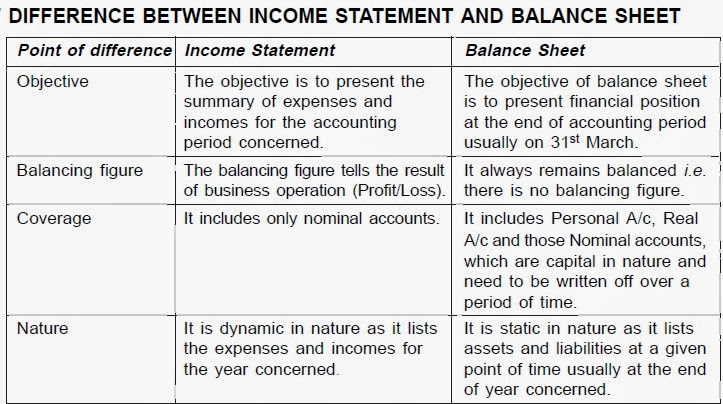

Unsure whether or not to favor a HELOC or house security financing? Realize HELOC against. house guarantee loan: Examine benefits and drawbacks.

Rent your home away

For many individuals, their house is their most significant, most profitable, and more than prized house. As well as need to hold onto they permanently, or perhaps as long as possible.

The easiest way to boost cashflow will be to end the house or property and you may rent it. You’ll be able to relocate to someplace quicker otherwise less costly. You can possibly buy the brand new home having fun with a mortgage otherwise 2nd home loan or just book they for under you are going to receive from your own clients.

Most other options so you can an other home loan

The fresh new CFPB implies that you speak about ways of reducing your expenses before you decide for the a reverse financial. Naturally, we usually curently have drawn sensible strategies determine their financial problem and you may rein inside their domestic finances.

But are your aware of software that might help with house solutions, tools, and you can strength costs? Talking about commonly work on because of the county, state, and you may town governments. Brand new CFPB suggests playing with locate these while some in which you live. Follow this link and you will get into the Area code.

An opposing home loan or HECM may be your absolute best or simply method give. However, think twice before you commit to you to.

And be sure to understand more about every possibilities in order to a face-to-face home loan. Financially, this is certainly a massive action. And you can believe they well worth consulting an independent economic coach in lieu of depending on a salesperson focusing on percentage to offer you an entire and you may precise photo.

And when you need a lump sum, area of the choices tend to be, downsizing, an earnings-aside re-finance, a home collateral mortgage otherwise an excellent HELOC. However might rent your property, score an excellent lodger, pare right back their outgoings, or score help from county otherwise regional bodies with some regarding your cost of living.

By using aside an individual content from this blog post, it ought to be it: Try not to just take such a major step versus a great amount of think, research, and you will, ideally, pro separate guidance.

Opposite mortgage FAQ

https://paydayloanalabama.com/ardmore/

For the majority older people, yet not all, you can find options to a reverse mortgage. Make sure you talk about these in advance of committing you to ultimately something it’s also possible to after regret.

Sure, considering your meet the lender’s criteria. Expect to you prefer a decent credit history, a workable burden regarding existing costs, and you will an ability to conveniently pay for your brand-new monthly premiums.

Contrary mortgage loans are just one choice. Pick all you need to learn about the remainder: cash-aside refinances, family collateral financing, and home security lines of credit. Like that, you can make the best choice.

There are a few. But probably the head one is how quickly the share of your house’s well worth drops since the lender’s share develops. Certain may afterwards be unable to pay for a beneficial proper care home otherwise to go out of up to that they had want to its heirs.

HELOCs try rotating personal lines of credit that enable people so you can obtain against the security within possessions. They’re an adaptable replacement a contrary home loan, as you’re able acquire the quantity you prefer, when you need it, and just spend attract into the borrowed count. But not, you will need to determine your own fees feature and regards to brand new HELOC ahead of considering it as an alternative.

A home guarantee loan, known as a moment financial, lets home owners so you’re able to obtain a lump sum of money up against the guarantee inside their assets. In the place of an other mortgage, that provides finance predicated on house equity, a house security loan need normal monthly payments. It could be the right option when you find yourself confident with normal financing payments and wish to avoid the intricacies out of an other home loan.